Financial Security at Monaco - AMSF

Monaco is the second smallest country in Europe, yet it has established itself as a major international financial center. Following a monetary union established with France in 1945, Monaco uses the euro, however, the majority of local financial institutions are controlled by French banks. To ensure the security of its financial system, Monaco also has its own regulatory authority: the Monegasque Financial Security Authority (AMSF).

Monegasque Financial Security Authority

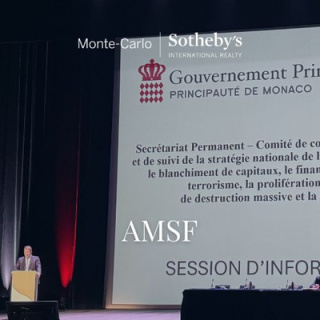

The role of the Monegasque Financial Security Authority (AMSF) is to regulate the country's financial activities. It oversees the Principality's anti-money laundering and anti-terrorist financing regime. A major player in international financial security, it is Monaco's main financial intelligence unit.

In July 2023, the AMSF took over from the Service of Information and of Controle on the Financial Circuits (SICCFIN). This transition transformed Monaco's financial intelligence unit from an administrative service into an independent authority. As a result, the AMSF now has autonomy over financial intelligence, compliance supervision and the application of sanctions.

Photo credits : AMSF

Role and responsibilities of Monegasque real estate agents

Monegasque estate agents play a crucial role in the fight against money laundering and terrorist financing. As a Monegasque real estate agency, Monte-Carlo Sotheby's International Realty is a key operational player in this safety system.

Monegasque real estate agencies are subject to the law and are involved in relaying compulsory information:

• Identify and verify the identity of prospects.

• Analyse transactions (particularly high-risk transactions or those > €10,000).

• Assess the risk profile of each customer.

• Report any suspicious transactions to the AMSF (via specific reports, formerly intended for SICCFIN).

Photo credits : Monte-Carlo Sotheby's International Realty

Agencies must therefore justify any real estate transaction by applying the guidelines published by the AMSF. At Monte-Carlo Sotheby's International Realty, we have implemented an internal control system that enables us to be efficient while guaranteeing absolute security for your personal information.

Anti-money laundering - reminder of law 1.362 of 3 August 2009

The loi n°1.362 de Monaco on the fight against money laundering, terrorist financing and corruption, is an important piece of legislation in the Principality. It was amended by law no. 1.462 of 28 June 2018 to comply with the 4th European directive on the fight against money laundering. The aim of this law is to strengthen measures to prevent and combat these offences, in particular by placing the emphasis on justified and accurate identification and verification of customers by professionals, as well as on a risk-based approach.

Find out more about Monte-Carlo Sotheby's International Realty, your expert in the real estate at Monaco / Monte-Carlo.

Published the 11/07/2025.